mobile al sales tax rate 2019

Mobile al sales tax rate 2019. State and Local Sales Tax Rates as of January 1 2019 State State Tax Rate Rank Avg.

Locations Mobile County Revenue Commission

Oxford AL Sales Tax Rate.

. Section 34-22 Provisions of state sales tax statutes applicable to article states The taxes levied by this article shall be subject to all definitions. Madison AL Sales Tax Rate. Automotive 40-23-24 40-23-61c.

The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales tax. Huntsville AL Sales Tax Rate. No state rates have changed since July 2018 when Louisianas declined from 50 to 445 percent.

Opelika AL Sales Tax Rate. The five states with the highest average combined state and local sales tax rates are Tennessee 947 percent Louisiana 945 percent Arkansas 943 percent Washington 917 percent and Alabama 914 percent. Manufacturing 40-23-23 40-23-61b.

MOBILE COUNTY TAX RATES. Ffxiv Ephemeral Nodes Primark Lincoln Opening Times Sunday My Hero Chords Oyster Party Pack Tight N Up Canvas Retensioner Navegación de entradas. Alabama Legislative Act 2010-268.

Impingement inklämd sena. The Mobile County Sales Tax is collected by the merchant on all qualifying sales made within Mobile County. The County sales tax rate is.

The Mobile County sales tax rate is. Vending all other 4000. Pelham AL Sales Tax Rate.

INSIDE MobilePrichard OUTSIDE MobilePrichard UNABATED EDUCATION LODGING. 4 rows Rate. A county-wide sales tax rate of 15 is applicable.

Monday Tuesday Thursday Friday. Mobile collects a 6 local sales tax the maximum local sales tax allowed under. Has impacted many state nexus laws and sales tax collection requirements.

Begränsade öppettider under sommaren samt julhelger. The minimum combined 2022 sales tax rate for Mobile County Alabama is. Phenix City AL Sales Tax Rate.

The Mobile Alabama sales tax is 1000 consisting of 400 Alabama state sales tax and 600 Mobile local sales taxesThe local sales tax consists of a 150 county sales tax and a 500 city sales tax. Enero 19 2021 en Uncategorized por. Alabama has 295 seperate areas each with their own Sales Tax rates with the lowest Sales Tax rate in Alabama being 4 and the highest Sales Tax rate in Alabama at 10.

Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as 100. Mobile AL Sales Tax Rate. Montgomery AL Sales Tax Rate.

Online Filing Using ONE SPOT-MAT. 10 rows Sales Tax. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent.

This is the total of state county and city sales tax rates. Mobile al sales tax rate 2019. This is the total of state and county sales tax rates.

Vending not machines Sales Use 40-23-25. Vending through Vending Machines. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee.

The 2018 United States Supreme Court decision in South Dakota v. The Mobile Sales Tax is collected by the merchant on all qualifying sales made within Mobile. Tacoma 102 percent and Seattle 101 percent Washington and Birmingham Alabama 10 percent.

Mobile County collects a 15 local sales tax less than. The Alabama state sales tax rate is currently. The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile County sales tax and 5 Mobile tax.

Mobile County in Alabama has a tax rate of 55 for 2022 this includes the Alabama Sales Tax Rate of 4 and Local Sales Tax Rates in Mobile County totaling 15. You can find more tax rates and allowances for Mobile County and Alabama in the 2022 Alabama Tax Tables. Hoover AL Sales Tax Rate.

Local Tax Rate a Combined Rate Combined Rank Max Local Tax Rate. City Ordinance 34-033 passed by the City Council on June 24 2003 went into effect October 1 2003. Sales Use Rental and Lodgings Tax Rates Sales and Use Tax Rates.

Farm Machinery 40-23-37 40-23-63. Vending food products 3000. General 40-23-21 40-23-61a.

Northport AL Sales Tax Rate. Sales and Use Tax. The Alabama sales tax rate is currently.

The minimum combined 2022 sales tax rate for Mobile Alabama is. How Does Sales Tax in Mobile compare to the rest of Alabama. What is the sales tax rate in Mobile Alabama.

Sales and Use taxes have replaced the decades old Gross Receipts tax. The Mobile County Sales Tax is 15.

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

Alabama Sales Use Tax Guide Avalara

States Without Sales Tax Article

States Without Sales Tax Article

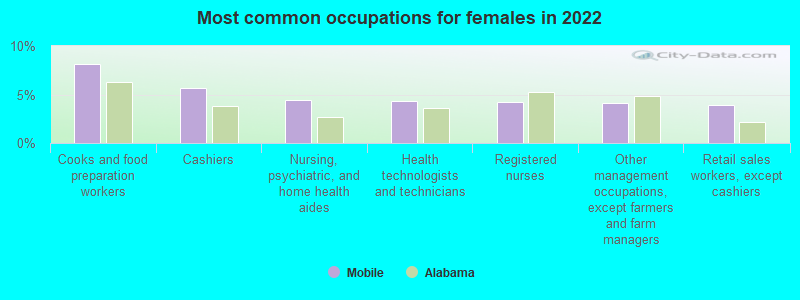

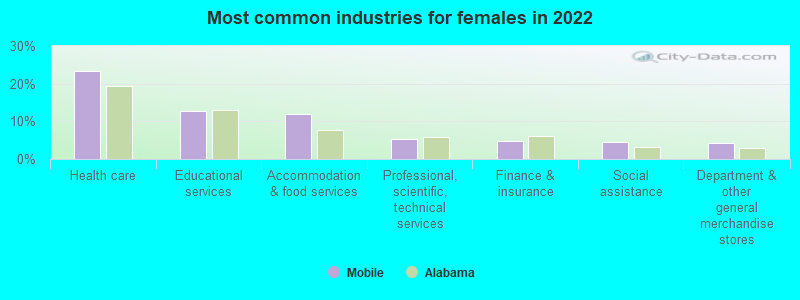

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Online Gst Accounting Software Made Easy Affordable For Smes Accounting Software Accounting Tax Services

Sales And Use Tax Rates Houston Org

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)